Capitalism put to work with gender diversity

More female leadership is correlated with stronger profitability; female investors more likely to care about ESG risks than men

INTERNATIONAL Women’s Day (IWD) will be celebrated this week, which gives us an opportunity to re-examine the merits of advocating for greater inclusivity at workplaces – and in particular, gender diversity.

The data suggest that gender diversity is more than a feel-good factor. Capitalism is put to work when companies choose to make inclusivity a priority.

Numerous studies show that more female representation in the leadership ranks is tied to stronger profitability. To add to that, if efforts continue to be made to narrow the pay gap on the gender front, more female investors – who are found to be more likely than men to care about environmental, social, and governance (ESG) risks – can be empowered to vote more decisively against ESG risks with their money.

Given this, an argument can be made that this situation creates a powerful virtuous cycle for businesses to be motivated to value their role as responsible corporate citizens, while better securing the bottom line.

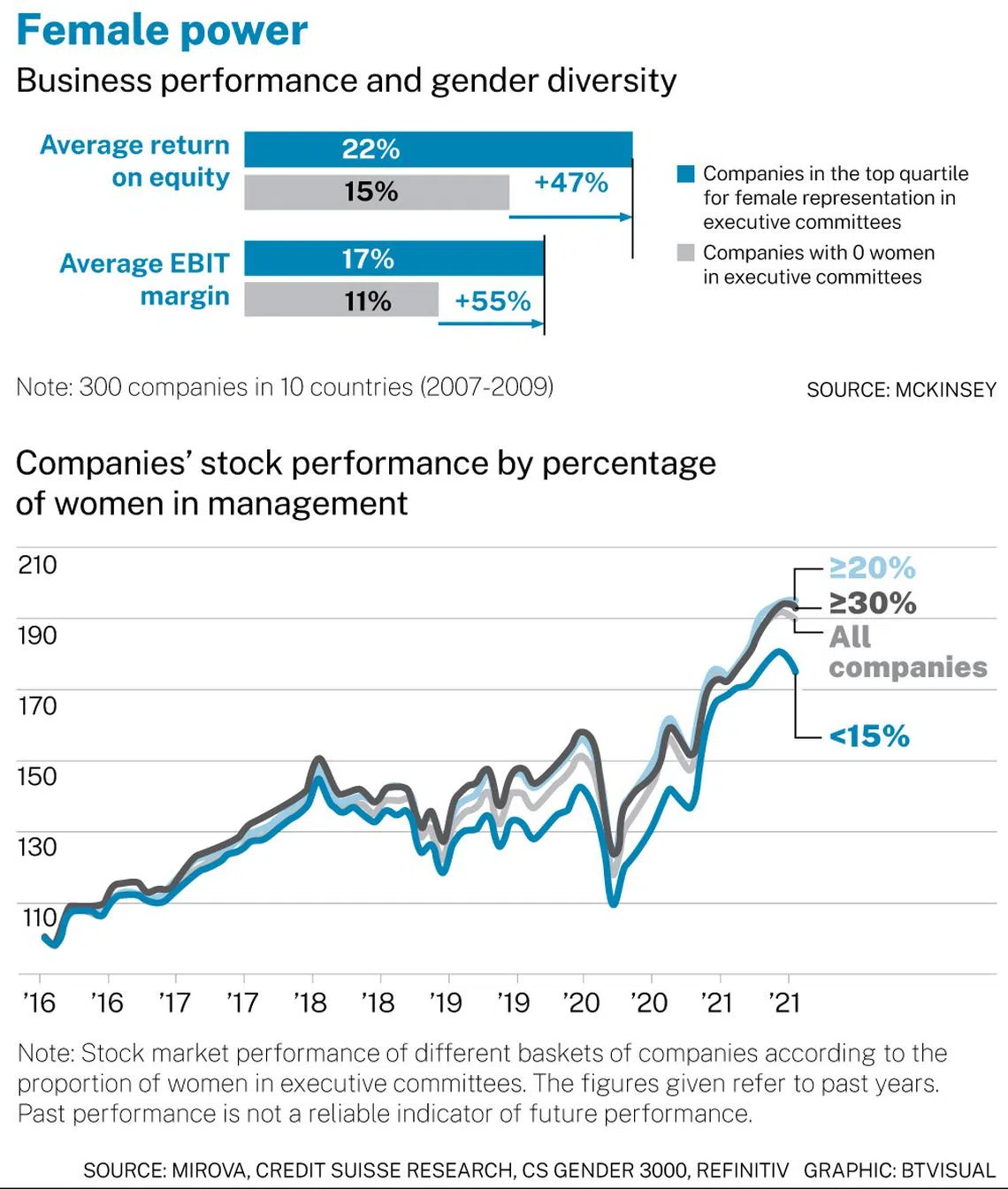

Let’s first review the data on hand. A 2017 McKinsey analysis of 300 companies worldwide showed that companies with the highest percentage of women on their executive committees bring about a 55 per cent premium in operating results.

Another 2016 study of nearly 22,000 global companies, by the Peterson Institute for International Economics and Ernst & Young, showed that several cases were found to have a correlation between the proportion of women in management and company profitability, with its magnitude “not negligible”.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Similarly, data from Credit Suisse’s 2021 report on gender diversity in the corporate sector showed that companies with more women in management positions tend to clock a better economic performance.

In a recent interview with fund manager Mirova, Michelin chief executive officer (CEO) Florent Menegaux was asked how he saw the link between diversity and performance. He pointed out that when the company evaluated past failures, many of them came down to the inability to foresee risks or to come up with alternative and innovative ideas. These failures, in turn, can be traced back to the excessively uniform viewpoints of project stakeholders, he said.

S&P Global Market Intelligence’s 2019 study found that female CEOs led a 20 per cent rise in stock price momentum while female chief financial officers saw a 6 per cent increase in profitability in the 24 months post-appointment. These results were determined to be economically and statistically significant.

Critically, the S&P report found that one driver of superior results by females may be that they are held to a higher standard, dispelling the idea that female executives with weaker skills were installed in order to meet a gender quota.

“The average female executive has characteristics in common with the most successful male executives, suggesting that common attributes drive success among males and females alike. Overall, the attributes that correlate with success among male executives were found more often in female executives,” the S&P report said.

“This finding refutes the commonly-held belief in ‘token’ female executives.”

Gender gap and ESG

It is clear that the current female representation in leadership ranks and on boards globally is not ideal. One silver lining though is that women are more likely to be chosen to head the sustainability portfolios of companies than men.

Executive search and leadership advisory firm Russell Reynolds’ 2021 data, reviewing 46 senior ESG leaders from large global organisations appointed over 18 months prior, found that seven in 10 were female.

Likewise, Credit Suisse noted that the proportion of heads of sustainability units who identified as female stood at almost 45 per cent of all such positions in its global dataset.

This is positive, given that a company’s approach to sustainability carries significant financial, reputational, and regulatory implications, while social and sustainability bonds are increasingly becoming a greater part of financing, the bank said.

“A company’s ESG rating can have a direct impact on its access to capital or indeed capital requirements. In that respect, an ESG rating affects a company’s cost of capital and ultimately its share price, making the role of growing significance.”

Another report from consulting and recruitment firm Kronor Group showed that over a period of two years to end-2021, nearly half (49.6 per cent) of ESG specialists hired by hedge funds globally were women. By comparison, women made up just 28.6 per cent of total hedge fund hires globally. More than 10,000 hedge fund hires were evaluated for the report.

That would also outstrip the overall gender representation at asset management firms. A 2021 Morningstar global survey found that just 14 per cent of fund managers were women.

Meanwhile, various studies show that women are significantly more likely than men to review potential investments holistically; they look into whether companies they invest in account for ESG factors.

However, data from the United Nations shows that women’s aggregate wages globally are only 77 per cent that of men. According to the World Bank, that reflects some US$160 trillion worth of lost human capital. Put simply, narrowing the gender gap has the potential to boost total global wealth.

Consider then, a world where there is greater representation of female leadership that raises the odds of better economic performance. In that same world, more global wealth and investment decision-making are in the hands of women who would channel capital to companies judged to be operating with lower ESG-related risks.

Taken together, championing for gender diversity is not for mere buzz. It may help to light the way towards a steadier path for inclusive capitalism. So this IWD, may the message of empowerment and the embrace of gender equity sound out a little louder – for good reason.

Jamie Lee is head of financial planning and editorial, and Min Axthelm is director of investment research at Endowus, an independent wealth platform advising over S$5 billion in individual and family client assets across public and private markets.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.