UOB’s Wee clan, Singapore’s richest banking dynasty, grapples with succession

BUILDING a multibillion-dollar empire is one thing. Keeping it in the family is another matter.

By the time Wee Cho Yaw died earlier this month at 95, his five children had firmly established roles within Singapore’s richest banking dynasty that forged a US$10 billion fortune. His eldest son, Wee Ee Cheong, 71, has led UOB since 2007, while his other two sons and two daughters, all over 60, hold management roles elsewhere in the empire.

Still, his more than a dozen largely millennial grandchildren have mostly pursued their own passions in business, from a three-star Michelin restaurant to co-founding a dry cleaning chain and a website selling Asian artwork.

Asked at a briefing last week about succession planning, Ee Cheong hinted that he’s open to an outsider taking over. UOB’s chief executive officer said he’s growing his “timber” of younger colleagues, an expression that translates to building the bank’s own talent pool of professionals.

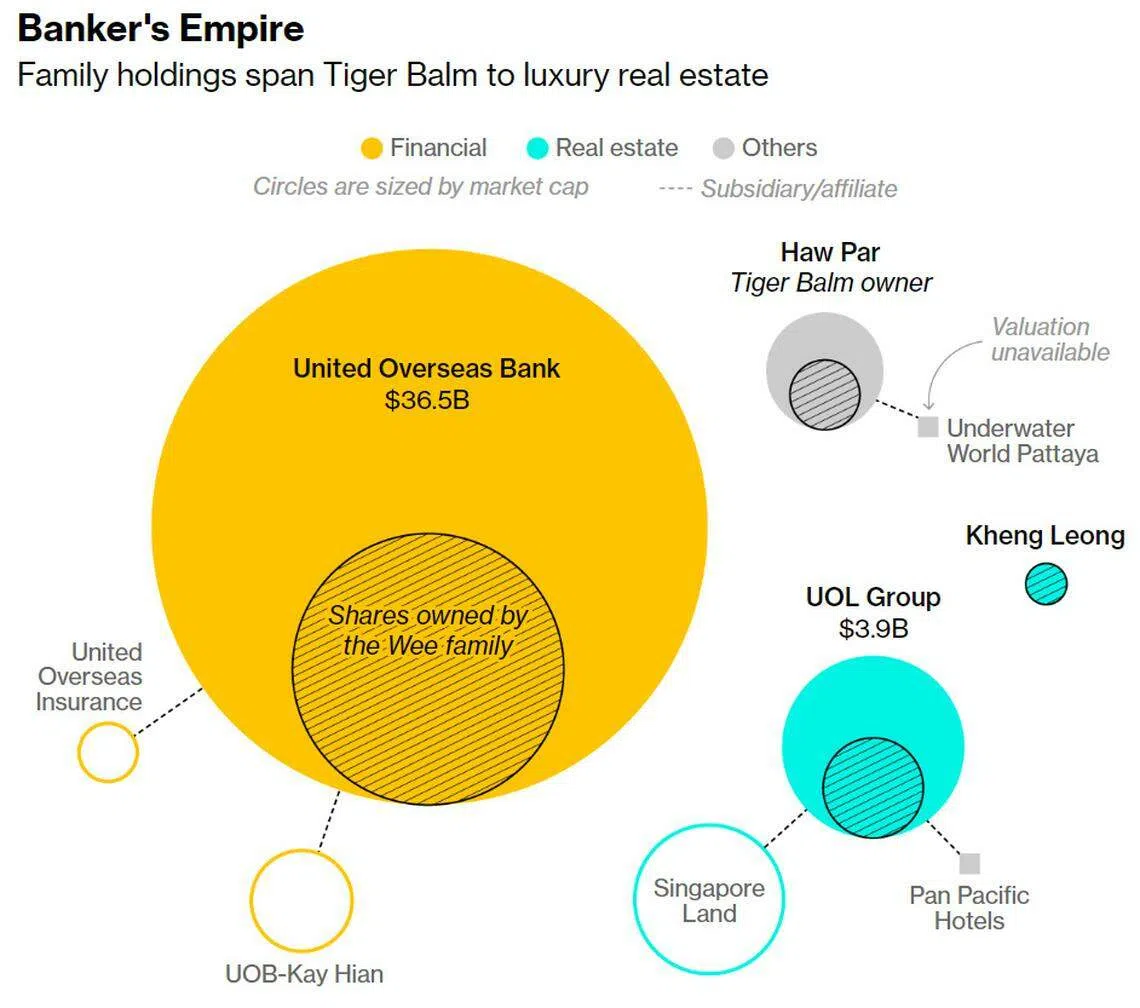

At stake is the clan’s long-term control of UOB, one of the last major family lenders in Singapore, as well as other jewels of the empire. Cho Yaw’s father, Wee Kheng Chiang, founded UOB in 1935 and it is now worth more than US$35 billion, while the family’s UOL Group is one of Singapore’s biggest real estate developers.

“The family needs to get used to a new type of decision-making, moving from a central family leader to a sibling partnership,” said Marleen Dieleman, professor of family business at IMD Business School in Singapore. “Wee Cho Yaw’s children are already of retirement age themselves, suggesting that another leadership succession is in the cards soon.”

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

For at least two decades, Cho Yaw’s five children have been major owners of the family holding companies, Wee Investments Pte and C Y Wee & Co, underscoring how Cho Yaw paved the way for his succession early on. He retired as chairman of UOB in 2013.

But the elder Wee, known as Singapore’s last banking titan who crossed paths with Xi Jinping when he was party secretary of Fuzhou, stayed heavily involved in other family businesses until his death.

Even in his later years, he continued his six-day week at UOB’s tower on the banks of the Singapore river, whose construction he had personally overseen in the 1990s. At the time of his passing, he chaired six companies, including UOL and Tiger Balm-maker Haw Par and held a stake in UOB worth US$3.2 billion that’s yet to be inherited.

Cho Yaw’s wish, he wrote in his 2014 biography, was that his grandchildren would take a prominent role in the family businesses. So far, that has not happened.

‘Need passion’

“If the family members are interested they’re more than welcome,” Ee Cheong said of who might succeed him at the head of the bank. “But I think they need passion, they need love, they need the desire to be part of the team.”

At Singapore-based rival OCBC, the billionaire Lee family withdrew from day-to-day management of the bank some years ago. Lee Seng Wee, the former chairman of OCBC, died in 2015, and his son Lee Tih Shih now sits on the board.

For the Wee clan, there is not a shortage of potential heirs to the fortune. The late Wee had 16 grandchildren and 22 great-grandchildren, according to an obituary published after his death. While any tension around succession is yet to make itself felt in public, his grandchildren have mostly gone their own way.

Ee Cheong’s eldest son, Wee Teng Wen, is the managing partner of The Lo and Behold Group, which owns and operates Odette, one of a handful of three-star Michelin restaurants in the city-state, and Tanjong Beach Club, a popular beachfront haunt for expat executives and Instagram models.

His other son, Wee Teng Chuen, left UOB’s corporate banking unit in 2020 to join a boutique real estate management platform that has since shut down. He also co-founded with his brother a dry cleaning chain, For the Love of Laundry.

Another of Cho Yaw’s grandchildren, Alexandra Eu, married a scion of the Kuok family, whose palm oil billionaire patriarch, Robert Kuok, is Malaysia’s richest person. After a stint on the management associate programme and then in private banking at UOB more than a decade ago, she now co-owns a coffee bar with her husband and co-founded a website selling Asian artwork.

Property billions

Outside of banking, Cho Yaw instigated the takeover of UOL’s predecessor in the 1970s, helping build a property portfolio spread across several companies that remains under the family’s control. UOL now oversees more than S$20 billion in assets and is Singapore’s second-largest listed developer, behind City Developments.

He also helped rescue Haw Par, which manages an aquarium in Thailand, Underwater World Pattaya, owns various properties in Singapore and is most famous for being the producer of Tiger Balm, an iconic pain-relief ointment that dates back to the times of the Chinese emperors.

A prominent scion is also making his way up the ranks through the real estate side of the empire. Jonathan Eu, another Cho Yaw grandson who is a Wharton School graduate, heads Singapore Land Group, a roughly US$2 billion UOL subsidiary. At a press conference on Tuesday (Feb 27), Eu said the Wee family’s stake in the property firm will remain the same for now.

“As the only Singapore bank now run by family, this makes UOB somewhat unique among its peers,” said Sarah Jane Mahmud, a banks analyst at Bloomberg Intelligence. “With few of Wee’s grandchildren working in financial services, there is a chance that UOB could end up being managed by so-called outsiders in the future.”

UOB declined to comment on the value of Cho Yaw’s UOB stake that is to be inherited. Teng Wen did not reply to a request for comment via LinkedIn, while Bloomberg News was not able to reach Teng Chuen.

Cho Yaw, who honed his business skills riding a boom in commodities trading in 1950s British-ruled Malaya, was well aware of the difficulties in keeping a family business together. In 2004, he had to fend off an attempt by state investor Temasek Holdings to buy out his family’s stakes in UOL. Before his death, Cho Yaw held about 30 per cent in the developer.

In his biography published in 2014, Cho Yaw said he invited his extended family for a meal every Sunday to keep in touch, and arranged for his children to live close to his mansion in Jalan Asuhan, a wealthy cul-de-sac north of Singapore’s Botanic Gardens.

Three of them – Wei Chi, Ee Cheong and Ee Lim – each own adjacent luxury bungalows in a nearby enclave, Camden Park, according to property records. Houses in the area are among the city-state’s most highly valued. A so-called good class bungalow on Jalan Asuhan sold for about US$30 million last year.

Cho Yaw said he did not know whether the fourth generation would take over the empire, he wrote in the book. “I can only hope they do,” he said. BLOOMBERG

Ageing heirs control family enterprises

Wee Wei Ling, 1951

Net Worth: US$800 million

Wee Cho Yaw’s eldest child holds a management role at the family’s Pan Pacific Hotels Group, one of Asia’s top chains overseeing more than 50 hotels, resorts and serviced apartments. She’s responsible for the sustainability strategy as well as the asset management of the hotels. Wee also founded and manages the group’s St Gregory spas and Si Chuan Dou Hua restaurants.

Wee Ee Cheong, 1953

Net Worth: US$4.5 billion

Ee Cheong is Cho Yaw’s eldest son and CEO of the flagship United Overseas Bank, making him the most public-facing executive in the empire. A career banker, he joined the lender in 1979 and became its CEO 17 years ago. He has also held directorships in other key companies of the family. A keen art enthusiast, he is the patron of the Nanyang Academy of Fine Arts, and has a masters in applied economics from American University in Washington. He is married and has three children.

Wee Ee Chao, 1955

Net Worth: US$2.4 billion

He’s the chairman and managing director of brokerage firm UOB-Kay Hian Holdings. While leading the stockbroking arm of UOB, Ee Chao is also CEO of luxury property firm Kheng Leong and a director of UOL Group, which oversees Pan Pacific. He chaired the Singapore Tourism Board from 2002 to 2004 and spearheaded the organisation’s efforts to minimise the impact of the SARS crisis in 2003. He was appointed chairman of healthcare company Haw Par, replacing his late father, on Feb 26.

Wee Ee Lim, 1961

Net Worth: US$3.9 billion

Ee Lim is the president and CEO of Haw Par. He joined the company in 1986 and has held the current position since 2003. Last year, he became chair of UOL subsidiary Singapore Land Group, and was appointed UOL’s chairman on Feb 27, succeeding his late father.

Wee Wei Chi, Unknown

Net worth: US$800 million

She’s been serving as director of Kheng Leong since 1981. Unlike her siblings, she does not hold other positions in the family’s businesses. She’s married to David Eu from the family that founded Eu Yan Sang, a company specialising in traditional Chinese medicine.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services