Indonesian miners’ credit quality tied to thermal coal for 4 to 5 years more: Fitch

THERMAL coal will continue to underpin the credit quality of Indonesian coal-mining companies for the next four to five years, amid a “slow and uneven” phasing out of the fossil fuel in the Asia-Pacific, said analysts at ratings agency Fitch Ratings.

Shubha Sethi, a director at Fitch’s Asia-Pacific corporate ratings team, said at a webinar that most coal companies’ plans to diversify away from thermal coal include greenfield projects that might require more time to finance and execute.

And while Indonesia might have sealed a US$20 billion foreign-funded energy transition deal under a Just Energy Transition Partnership (JETP), the deal’s impact will be felt only five to 10 years later.

Sethi cited Indonesian coal giant Adaro Energy’s US$728 million aluminium smelter project as a greenfield project that would take at least two to three years to execute. The project was announced in December 2022, and sits on a new industrial estate in Borneo.

She said that, similarly, Adaro peer Indika Energy was working towards raising non-coal revenue to 50 per cent by 2025. But Indika’s key coal-mining subsidiary, Kideco Jaya Agung, would still account for 80 to 90 per cent of its earnings for at least the next two to three years.

“Only after that will we see some earnings from the new investments it has been making; but we don’t think it will be significant enough to have an impact on credit for the first one to two years of operations,” Sethi added.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Expect stability, even growth

In fact, Fitch expects Indonesia’s coal production levels to remain stable or even grow moderately in the medium term, to meet an anticipated growth in power demand from developing Asean economies.

Given that coal exports are a major revenue stream for Indonesia, Sethi said: “As of now, we do not expect to see a trend of early decommissioning of coal-fired power plants.

SEE ALSO

“We are not expecting even the coal-mining capabilities to show any trend of shutdown in the foreseeable future,” she added.

She also noted that while the Indonesia JETP signalled the Indonesian government’s willingness to accelerate the transition away from coal, the plan faced “implementation risks” in the near term.

Aurelia Britsch, senior director and global head of climate research at Sustainable Fitch, called the JETP “very ambitious but also extremely vague”, while describing a “contradictory push-and-pull approach” to climate policy in Indonesia.

Although the country pledged in 2021 to stop developing new coal plants, an exemption was made for coal plants already in the pipeline or attached to nationally strategic projects, she noted. While additional electrical capacity after 2023 is restricted to renewable sources, Indonesia’s list of allowable renewables lumps controversial sources, such as biomass and gasified coal, alongside solar and wind.

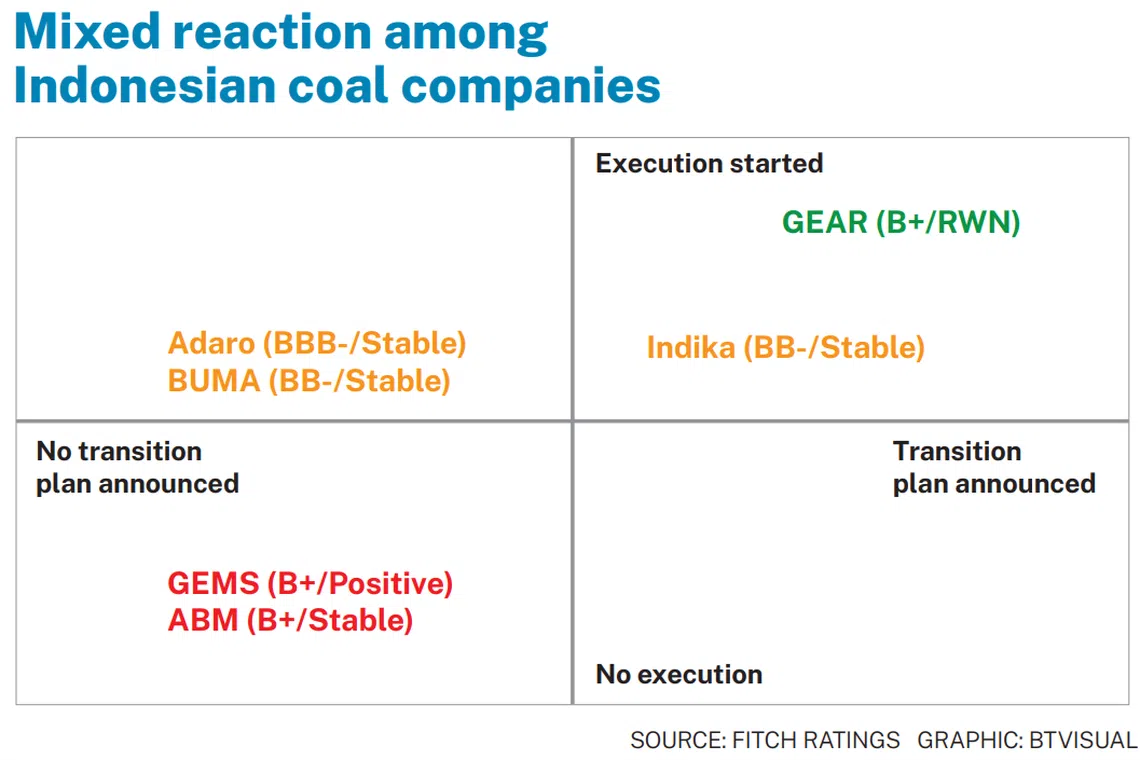

Sethi said that Indonesian coal companies’ reactions to the policy developments had been “quite mixed”.

Among the six companies her team tracked, two – Golden Energy Mines (Gems) and ABM Investama – had not shown signs of diversifying their earnings beyond thermal coal.

Singapore-listed Golden Energy and Resources (Gear) was the only tracked entity found to be in the process of exiting the thermal coal industry. It has proposed a distribution-in-specie of its shares in Jakarta-listed Gems to its shareholders. Even so, Sethi noted its pivot to metallurgical coal – also known as coking coal – instead of moving beyond coal entirely.

Meanwhile, Bukit Makmur Mandiri Utama (Buma) has been active in the acquisition space, despite not formally announcing a diversification plan. It marked its entry into coking coal in 2021 through an acquisition of Downer EDI’s coal mining contractor business in Australia.

Financing issues

Sethi said that the thermal coal mining sector had not really faced underwriting troubles, even as banks tightened their financing over the last two to three years.

She explained that this was because banks had been slow to reduce their exposure to coal companies. The approach for a number of banks was to only stop new lending, with targets for zero coal set in the medium term.

“Forming new banking relationships for coal companies has become more challenging, but existing relationships are still supported,” she said.

She added that while international banks had grown wary, certain regional banks in Indonesia, Vietnam and Thailand were still open to the coal sector.

Financing is, in any case, not a dire need, since most thermal coal companies’ financial positions substantially improved in the past two years on the back of stronger coal prices. Coal companies have not only accumulated robust cash positions; some of them have enough to finance early liability management and deleveraging. Sethi said there was also enough cash to support investment plans for diversification.

Taking these into account, the next major refinancing requirement would now be between 2024 and 2026, when some bonds come due, she said. “We haven’t seen any companies having a tightening rating headroom at this point.”

The analysis hinges upon buoyant coal prices, however. Sethi said the coal miners’ credit profiles could get negatively affected by a decline in price. Fitch is monitoring the changing landscape to see if funding tightens too quickly.

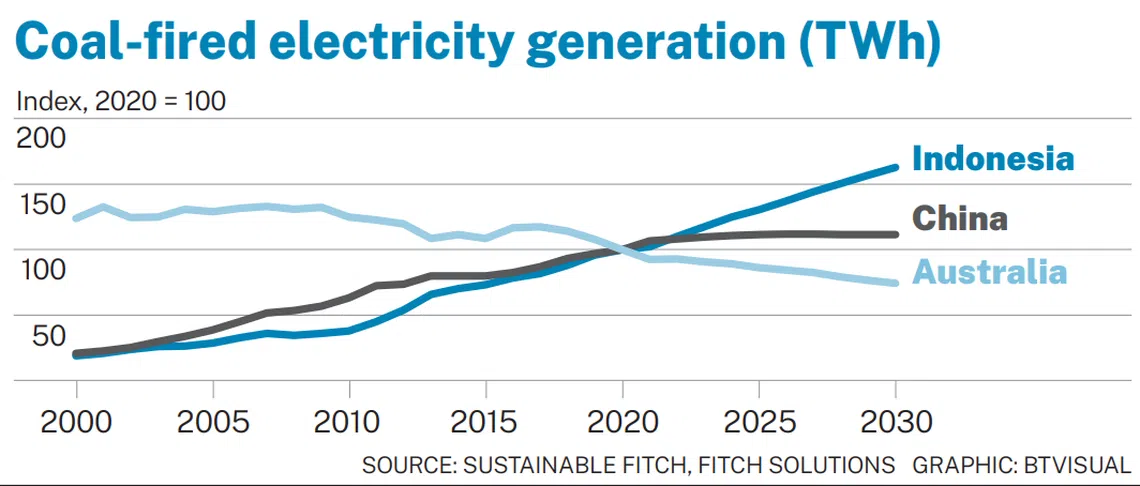

The situation in China is similar to Indonesia’s, where coal asset retirement is a much longer-term prospect. China’s focus is on expanding generation capacity to build energy security, a stark reversal from the past decade’s trend of shutting down old plants to fight overcapacity.

The situation is different in Australia, however. There, a clear policy shift is contributing to power companies expediting coal phase-outs. Sustainable Fitch analysts noted in a Mar 6 report that the closure dates for some of Australia’s largest coal plants had been brought forward by several years.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.